If you're considering buying a home or have a current mortgage deal expiring, you may be wondering how mortgage rates will develop in the coming months. The Bank of England will announce its next interest rate decision on June 22.

The bank's monetary policy committee meets roughly every six weeks to vote on whether to adjust rates and by how much.

The base rate is important because it affects how much people can earn from their savings and how much they pay on loans, including mortgages In May, the bank raised interest rates to 4.5% - the highest level in 14 years. Our 12 consecutive interest rate hikes since December 2021 are aimed at bringing down high inflation.

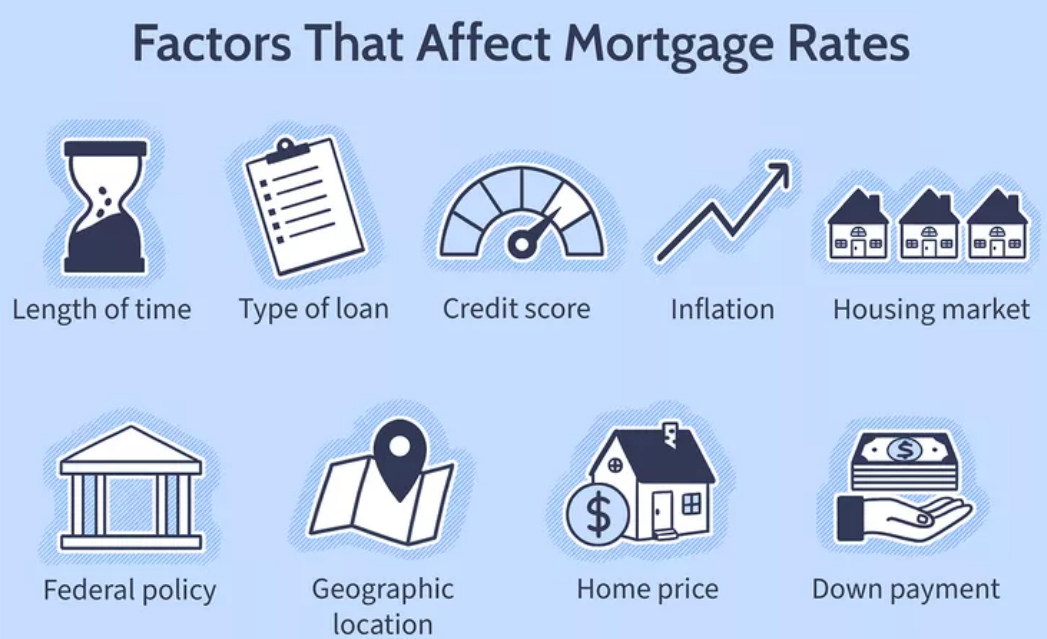

Although we saw an increase in the base rate last month, this did not translate into an increase in mortgage rates, which were flat for some time after the announcement. Instead, it was the better-than-expected inflation data released on May 24th that sent the mortgage market into turmoil, sending rates up rapidly.

The government set a 2% inflation target for the bank, which is why it said it would consider raising rates again until inflation is under control. Although inflation fell from 10.1% to 8.7% in May, it was still higher than market expectations and led to the view that interest rates must rise more than previously expected.

Since May 24th, stubbornly high inflation has caused the swap rate -- the basic cost of mortgage loans for lenders -- to rise by about 1%. Those costs are now passed on to borrowers, causing mortgage rates to rise.

What could happen to interest rates?

Currently, the market expects the bank may raise interest rates again in June.

However, energy costs are expected to fall and inflation is expected to fall to around 5% by the end of the year. As a result, the policy rate is likely to peak at around 5.75% as the bank continues to monitor the longer-term impact of successive rate hikes on lowering inflation.

How are interest rate rises affecting mortgage rates?

Mortgage expert from Rightmove, Matt Smith said: "In the past fortnight average fixed rates have risen across all loan-to-value ranges. This is due to the increasing underlying costs of mortgages, in response to a lower-than-expected fall in inflation in May."

“Looking ahead, we anticipate an increase in Base Rate by up to 0.5% on 22 June, but lenders have already factored this into their mortgage rates with increases in recent weeks. Given the impact of the most recent inflation figures, the next publication of this data, on 21 June, is more likely to have an influence on the direction of mortgage rates in the immediate term.

“If inflation is aligned with, or exceeds the expectations of the financial markets, we can expect to see mortgage rates stabilise. But if inflation remains stubbornly high and additional Base Rate increases are anticipated, it’s likely we’ll see mortgage rates rise further”, he adds.

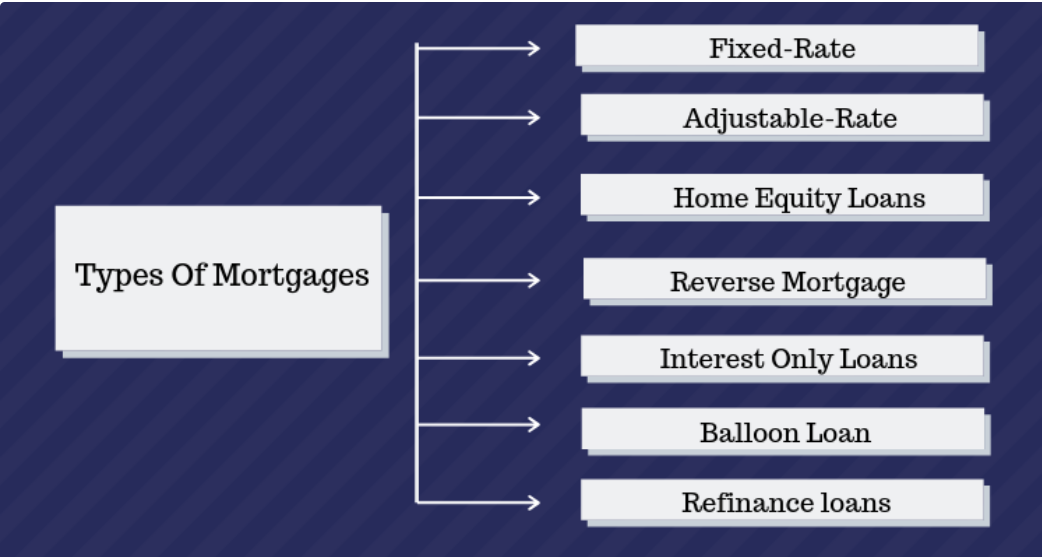

How could different types of mortgages be affected?

If you have a fixed-rate mortgage, the good news is that your payments won't change, at least not until your current contract ends. However, if your fixed-price product is due to expire within the next six months, you might want to see if signing up now is a good option for you. Since the cost of borrowing is significantly higher than it was five or even two years ago, you'll likely get a higher interest rate, and therefore higher monthly payments.

A mortgage broker or your lender's mortgage advisor can advise you on the options that are best for your situation. If you're one of the estimated 15% trackers or a variable-rate mortgage holder, you'll find your monthly payments growing incredibly fast. That's because tracker mortgages are usually calculated using the bank's rate plus a percentage.

A benefit of a tracker or variable mortgage is that you may see your monthly payments start to drop after rates have reached their peak and start to come down.

When could interest rates start to drop?

Right now, it’s thought that we could see Base Rate peak at around 5.75%, before it starts to come down.

The Bank of England’s Monetary Policy Committee meets about every six weeks to discuss and vote on whether interest rates should go up or down, or stay the same.

The next decision on interest rates will be announced on 22 June, followed by 3 August 2023.